fi-du-ci-ar-y responsibility: A legal obligation of one party to act in the best interest of another. The obligated party is typically a fiduciary, that is, someone entrusted with the care of money or property. Also called fiduciary obligation.

Simplify your 401(k), 403b and 457 plan

with our On Plan Money Management™ Option

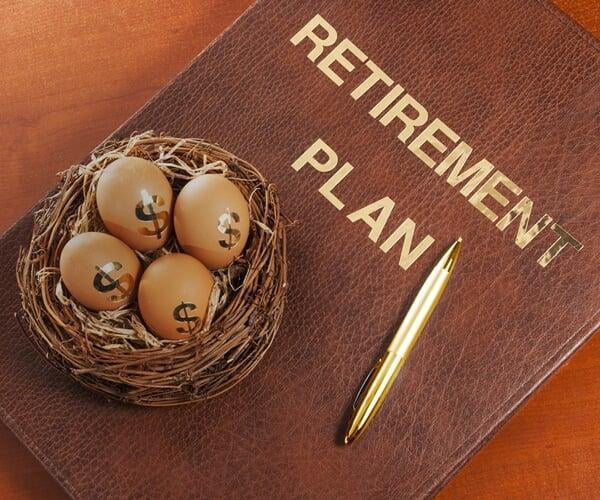

A powerful choice is available in thousands of defined contribution plans that can introduce you to a world of investment opportunities. It's time to unlock the power of your employer sponsored retirement account and maximize this benefit!

We Can Help!

What we will do for you:

- Personalize your retirement to meet you and your family needs, goals & objectives

- Monitor your account daily why you are working being the best you can be in your profession

- Manage your assets and make adjustment based on market conditions and your stated goals

- Ongoing advice and quarterly reviews

Start by asking yourself this simple yet powerful question. Are you making the right choices with the money in your 401(k), 403(b) or 457 plan? If you answered no! Follow the next simple four steps.

Here are the next steps:

Step One: Independent Advice Matters - Schedule a meeting/virtual meeting to receive Professional Advice from a Local Independent Financial Adviser. Keep in mind there are no upfront or any out of pocket cost to you at all for this employer based benefit and service. Best of all, you money stays in the plan. This means you not only continue to make regular contributions, you can make changes whenever you'd like to.

Step Two: Offer you Options - based on your specific situation, your local adviser will help you choose the best investment strategy that is right for you and meets your risk tolerance.

Step Three: Enact Your Plan - With the help of your adviser he/she will help you select the professional money management team that is on your employer retirement plan platform that invest your retirement plan assets, and these managers along with their research team continuously monitor market conditions and will make adjust accordingly and rebalance your portfolio so it stays in-line with your risk/reward tolerance and long-term investment goals.

Step Four: Ongoing Reviews - You receive regular quarterly, and annual meetings. Should you need to reach your adviser before your review he/she is just a phone call away or virtual meeting away. Now you have a fiduciary that puts your best interest first!

Take action so you can Retire On Your Terms™

Where does investment growth come from?

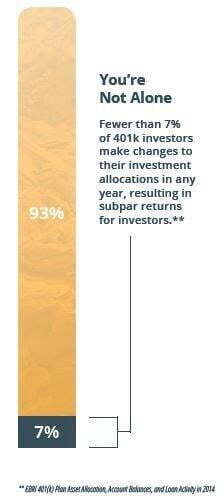

Less than 7% of 401(k) investors make changes to their investment allocations in any year.**

WHY?

Investing is confusing. Many 401(k) investors don't have the time to keep up with the financial markets. They simply don't know what to do. Therefore, they do nothing.

The results are not surprising.

** EBRI 401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2014

Benefits of Receiving Professional Management

Three Common Barriers to Higher Income at Retirement:

- Most people don't have the time. This is where we come in. We monitor the markets for you.

- Not everyone has knowledge about investing and the financial markets, and that's OK. It's what we do.

- Most people want some help but don't have a desire to become the financial expert. We provide the guidance and advice you want and need. And there are NO upfront or out of pocket cost to you at ALL! Plus your money stays within you plan.

You're Not Alone!

Professional Money Management

Incredibly, almost 90% of 401(k) participants [1] reallocate less than once a year. This can leave savers vulnerable to a constantly shifting economic landscape. With the help of your local advisor, our money managers adjust your defined contribution plan allocation to account for your specific risk tolerances, as well as changes in the market. This could help you achieve your goals and better prepare you for life after you retire.

Local Trusted Advisor

Your dentist is local. So is your doctor. They’re familiar with your needs. That kind of peace-of-mind adds value to your life. Local advisors who offer On-Plan Money Management are knowledgeable about your employer’s retirement plan, and may provide holistic advice on all aspects of your financial life.

Simple. Easy. Done.

Because all your savings stays within your existing retirement plan, getting started using the On-Plan Money Management Option is easy. The money stays right where it is. You can continue to make contributions, or change your risk tolerance any time you like. And best of all, there are no up-front fees. Contact us today to get started.

Disclosures: 1] Source: ICI Survey of DC Plan Record-keepers (2008-2011)

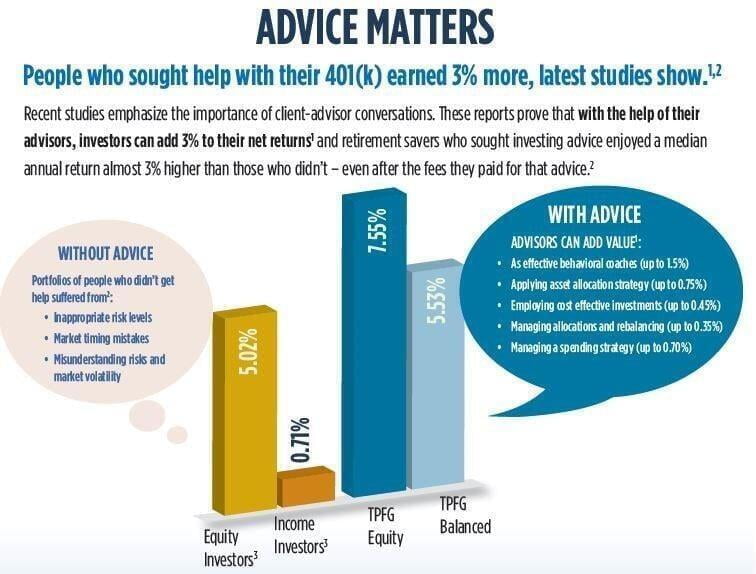

(1) According to Vanguard’s study based on their Alpha framework. Putting a value on your value: Quantifying Vanguard Advisor’s Alpha, Vanguard Research, 2014

(2) According to the study of eight large 401(k) plans with more than 425,000 participants and $25 billion in assets, by Aon Hewitt, a consulting firm, and Financial Engines, an investment advisory firm, between 2006-2010.

(3) Dalbar Study- Returns are for the period ending December 31, 2014. Average equity investor and average bond investor performance results are calculated using data supplied by the Investment Company Institute. Investor returns are represented by the change in total mutual fund assets after excluding sales, redemptions, and exchanges. This method of calculation captures realized and unrealized capital gains, dividends, interest, trading costs, sales charges, fees, and any other costs.

(4) TPFG Equity and TPFG Balanced portfolios are net of management fees including the IAR fee of up to 1%. This is a time-weighted return for the period of 01-01-1995 to 12-31-2014.

Returns quoted are net of management fees only and they do not reflect income taxes that the investor would have incurred. All performance results are based upon a composite of client portfolios that have

elected this investment strategy. This composite contains all accounts that have selected this strategy that meet the following requirements: all accounts must have been invested for at least a full month, and TPFG has full discretionary investment authority. All accounts that do not contain investment restrictions that significantly impair TPFG’s ability to manage the assets according to the applicable strategy are considered discretionary. The composite process removes accounts under the composite minimums, accounts with pending or processed cash flows greater than%of the beginning period market value, accounts that have been traded by the client during the month, accounts held at custodians that do not have an institutional trading platform to facilitate bulk trading, and accounts that do not pay a management fee. Actual returns for individual client accounts may vary and do not necessarily coincide exactly with the returns for the composite. Past performance is no guarantee of future returns. Investing in any security involves a risk of loss.