Our Investment Selection Process

Our disciplined, multi-stage investment selection process leverages Modern Portfolio Theory to create robust, faith-aligned investment strategies.

A Word About Modern Portfolio Theory

Our disciplined, multi-stage investment selection process leverages Modern Portfolio Theory to create robust, faith-aligned investment strategies.

Modern Portfolio Theory formalizes the concept of diversification, showcasing that an investor can achieve an optimal portfolio with the maximum expected return for a given level of risk by spreading one’s portfolio across uncorrelated assets. The theory emphasizes the importance of the portfolio’s overall risk and return, rather than focusing on the attributes of individual assets.

Markowitz’s key insight is that the risk of a portfolio can be reduced more effectively through diversification if the returns of the assets included are uncorrelated. In other words, by combining investments whose returns do not move in tandem, a portfolio can yield higher returns for a given level of risk or lower risk for a given level of return. This concept is the cornerstone of Modern Portfolio Theory and underpins the rationale for diversification.

Markowitz famously summarized the essence of this theory with the quote, “diversification is the only free lunch in investing,” implying that diversification across uncorrelated asset classes and strategies allows investors to reduce their risk without a corresponding decrease in expected returns. This “free lunch” is achieved by exploiting the benefits of combining different assets to enhance return potential relative to risk.

For example, if an investor adds one uncorrelated asset to a portfolio (two assets now held), portfolio risk would be reduced by 29%. If a one-asset portfolio were diversified to six uncorrelated assets, the portfolio’s risk would decline by nearly 60%.

Interestingly, even adding a risky asset to a portfolio can reduce overall portfolio risk if it is uncorrelated or negatively correlated, despite its high volatility. In contrast, adding 50 tech stocks to a 10-tech stock portfolio would achieve very little, if anything, for portfolio diversification, given these additional assets are all highly correlated.

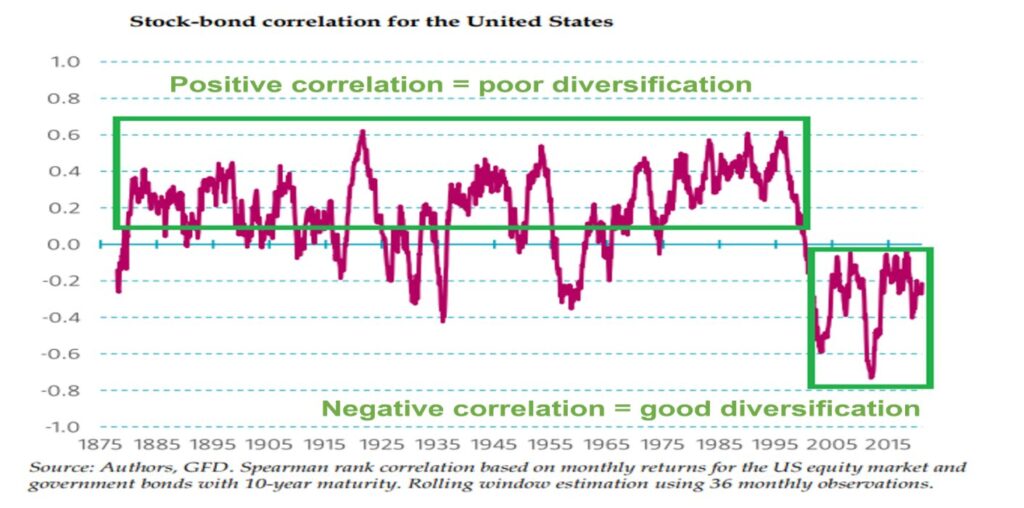

Historically, the traditional “balanced” portfolio of stocks and bonds was deemed a diversified asset allocation framework.

However, throughout most of modern history, stocks and bonds have been positively correlated, making bonds a poor stock portfolio diversifier, save for the twenty years before 2022.

A new approach is needed because investors can generate the same or greater return with far less risk through diversification. The stock market has generated excellent returns for investors over the long term, but allocators have unnecessarily had to stomach some gut-wrenching volatility. Why not utilize a more diversified approach with the goal of generating the same or better returns, with far lower risk?

With that, our Founder & CEO has developed what may be one of the few if not only risk-adjusted group of faith-based Judeo-Christian and Islamic Shariah-Compliant fund-to-fund portfolios.

How did we do it?

Each portfolio is constructed using MPT principles to optimize risk-adjusted returns. The selection process involves:

- Scanning the universe of equity, bond, and Sukuk securities

- Applying a proprietary faith-based screen to ensure Shariah compliance (only used on our EPI portfolios)

- Selecting the lowest-cost options to maximize efficiency

- Utilizing BlackRock’s Aladdin engine for advanced risk factor analysis[^4]

Our comprehensive approach presents investors with two distinct yet complementary portfolio suites: the flagship value-driven NCFA/Cyborg-Advisors portfolios and the Ethical Pathway Investment Portfolios, which adhere to Shariah-compliant principles. These meticulously crafted portfolios cater to a spectrum of risk tolerances, leveraging cutting-edge financial theory and sophisticated risk management techniques. Each offering is distinguished by its optimized risk-adjusted profile, competitive performance, and cost-efficiency, providing a robust framework for both ethical and financially prudent investment decisions.

To be Sharia compliant, companies and investments must pass several screens for permissible asset classes and business activities. Stocks and Islamic ETFs are eligible for Sharia compliance consideration, but preferred shares and interest-paying securities are not. A business activities screen excludes companies that derive more than five percent of their total income from non-compliant income sources.

Non-Compliant Income Sources:

- Alcohol

- Gambling

- Weapons

- Tobacco

- Adult Entertainment

- Pork Products

- Highly leveraged Businesses

- Interest-Based Businesses

- Music, Cinema or Broadcasting

- Credit Cards

An overview and detailed description of each portfolio is under their respective tabs.

Stage 1

ETF Universe Evaluation

Modern Portfolio Theory (MPT) Foundation

- Comprehensive ETF screening using MPT principles

- Focus on diversification across asset classes

- Analysis of expected returns and risk characteristics

- Analysis of expected returns and risk characteristics

Stage 2

Cost Optimization

Lowest Cost Strategy

- Prioritize ETFs with minimal expense ratios

- Compare the total cost of ownership

- Balance between low fees and performance potential

- Target expense ratios below industry benchmarks

Stage 3

Faith-Based Screening

Proprietary Ethical Investment Screen

- Alignment with faith-based investment principles Judeo, Christian, and Islamic (Shariah compliant)

- Exclusion of companies conflicting with ethical guidelines

- Positive screening for socially responsible investments

- Transparent screening methodology

Stage 4

Risk Management

BlackRock Aladdin Risk Analysis

- Advanced risk assessment using cutting-edge technology

- Comprehensive portfolio risk modeling

- Key metrics evaluated:

- Volatility

- Potential drawdowns

- Correlation risks

- Stress testing scenarios

Final Portfolio Construction

- Integrated approach combining all four evaluation stages

- Dynamic, adaptable investment strategy

- Regular portfolio rebalancing and review

Stage 1

ETF Universe Evaluation

Modern Portfolio Theory (MPT) Foundation

- Comprehensive ETF screening using MPT principles

- Focus on diversification across asset classes

- Analysis of expected returns and risk characteristics

- Analysis of expected returns and risk characteristics

Stage 2

Cost Optimization

Lowest Cost Strategy

- Prioritize ETFs with minimal expense ratios

- Compare the total cost of ownership

- Balance between low fees and performance potential

- Target expense ratios below industry benchmarks

Stage 3

Faith-Based Screening

Proprietary Ethical Investment Screen

- Alignment with faith-based investment principles Judeo, Christian, and Islamic (Shariah compliant)

- Exclusion of companies conflicting with ethical guidelines

- Positive screening for socially responsible investments

- Transparent screening methodology

Stage 4

Risk Management

BlackRock Aladdin Risk Analysis

- Advanced risk assessment using cutting-edge technology

- Comprehensive portfolio risk modeling

- Key metrics evaluated:

- Volatility

- Potential drawdowns

- Correlation risks

- Stress testing scenarios

Final Portfolio Construction

- Integrated approach combining all four evaluation stages

- Dynamic, adaptable investment strategy

- Regular portfolio rebalancing and review

Disclaimer: Investment strategies involve risk. Consult financial advisor for personalized guidance.

Stage 1

ETF Universe Evaluation

Modern Portfolio Theory (MPT) Foundation

- Comprehensive ETF screening using MPT principles

- Focus on diversification across asset classes

- Analysis of expected returns and risk characteristics

- Analysis of expected returns and risk characteristics

Stage 2

Cost Optimization

Lowest Cost Strategy

- Prioritize ETFs with minimal expense ratios

- Compare the total cost of ownership

- Balance between low fees and performance potential

- Target expense ratios below industry benchmarks

Stage 3

Faith-Based Screening

Proprietary Ethical Investment Screen

- Alignment with faith-based investment principles Judeo, Christian, and Islamic (Shariah compliant)

- Exclusion of companies conflicting with ethical guidelines

- Positive screening for socially responsible investments

- Transparent screening methodology

Stage 4

Risk Management

BlackRock Aladdin Risk Analysis

- Advanced risk assessment using cutting-edge technology

- Comprehensive portfolio risk modeling

- Key metrics evaluated:

- o Volatility

- o Potential drawdowns

- o Correlation risks

- o Stress testing scenarios

Final Portfolio Construction

- Integrated approach combining all four evaluation stages

- Dynamic, adaptable investment strategy

- Regular portfolio rebalancing and review

Stage 1

ETF Universe Evaluation

Modern Portfolio Theory (MPT) Foundation

- Comprehensive ETF screening using MPT principles

- Focus on diversification across asset classes

- Analysis of expected returns and risk characteristics

- Analysis of expected returns and risk characteristics

Stage 2

Cost Optimization

Lowest Cost Strategy

- Prioritize ETFs with minimal expense ratios

- Compare the total cost of ownership

- Balance between low fees and performance potential

- Target expense ratios below industry benchmarks

Stage 3

Faith-Based Screening

Proprietary Ethical Investment Screen

- Alignment with faith-based investment principles Judeo, Christian, and Islamic (Shariah compliant)

- Exclusion of companies conflicting with ethical guidelines

- Positive screening for socially responsible investments

- Transparent screening methodology

Stage 4

Risk Management

BlackRock Aladdin Risk Analysis

- Advanced risk assessment using cutting-edge technology

- Comprehensive portfolio risk modeling

- Key metrics evaluated:

- o Volatility

- o Potential drawdowns

- o Correlation risks

- o Stress testing scenarios

Final Portfolio Construction

- Integrated approach combining all four evaluation stages

- Dynamic, adaptable investment strategy

- Regular portfolio rebalancing and review

- Comprehensive ETF screening using MPT principles

- Focus on diversification across asset classes

- Analysis of expected returns and risk characteristics

- Identification of low-correlation investment opportunities

- Prioritize ETFs with minimal expense ratios

- Compare the total cost of ownership

- Balance between low fees and performance potential

- Target expense ratios below industry benchmarks

- Alignment with faith-based investment principles Judeo, Christian, and Islamic (Shariah compliant)

- Exclusion of companies conflicting with ethical guidelines

- Positive screening for socially responsible investments

- Transparent screening methodology

- Advanced risk assessment using cutting-edge technology

- Comprehensive portfolio risk modeling

- Key metrics evaluated:

- Volatility

- Potential drawdowns

- Correlation risks

- Stress testing scenarios

- Integrated approach combining all four evaluation stages

- Dynamic, adaptable investment strategy

- Regular portfolio rebalancing and review

Disclaimer: Investment strategies involve risk. Consult financial advisor for personalized guidance.